Managing finances can be a daunting task for students, but with the right tools, it becomes much easier.

The right apps can help students budget, track expenses, and save for future goals—all from the convenience of their smartphones.

This article examines the top apps to help students manage their finances and alleviate financial stress.

Importance of Managing Student Finances

Managing finances is crucial for students, as it impacts both short-term goals and long-term stability.

Developing good financial habits early lays the foundation for future well-being. Here are key reasons why it’s essential for students:

- Avoiding Debt: Helps prevent unnecessary debt from credit cards, loans, and daily expenses.

- Building Credit: Establishes a good credit score for future financial activities.

- Saving for Future Goals: Enables saving for future needs, such as emergencies or post-graduation expenses.

- Responsible Spending: Encourages prioritizing needs over wants and reducing impulse buys.

- Reducing Financial Stress: Lowers anxiety by giving students more control over their finances.

- Financial Independence: Promotes independence by reducing reliance on others for financial support.

Criteria for Choosing the Best Finance Apps

With numerous options available, it’s essential to prioritize features that best suit your needs. Here are key criteria to consider:

- User-Friendly Interface: Should be easy to navigate and simple for daily use.

- Budgeting Tools: Enables setting budgets and tracking expenses.

- Expense Tracking: Automatically tracks and categorizes your spending.

- Bank Integration: Syncs with your bank accounts for smooth tracking.

- Security Features: Offers encryption and two-factor authentication.

- Reports & Insights: Provides financial reports to track progress.

- Customization: Allows personalization of goals, alerts, and categories.

Top Apps for Managing Student Finances

These tools are designed to help students stay on top of their finances by offering features that track spending, create budgets, and encourage saving.

Here’s a list of some of the top apps that can make managing finances easier:

Mint

Mint is a free budgeting tool that helps students track their spending, set budgets, and manage their finances in one place. It also offers credit score tracking.

Features:

- Tracks expenses automatically

- Creates customized budgets

- Monitors credit scores

- Provides financial insights and tips

Best For:

- Budgeting and expense tracking

- Credit score monitoring

- Overall financial management

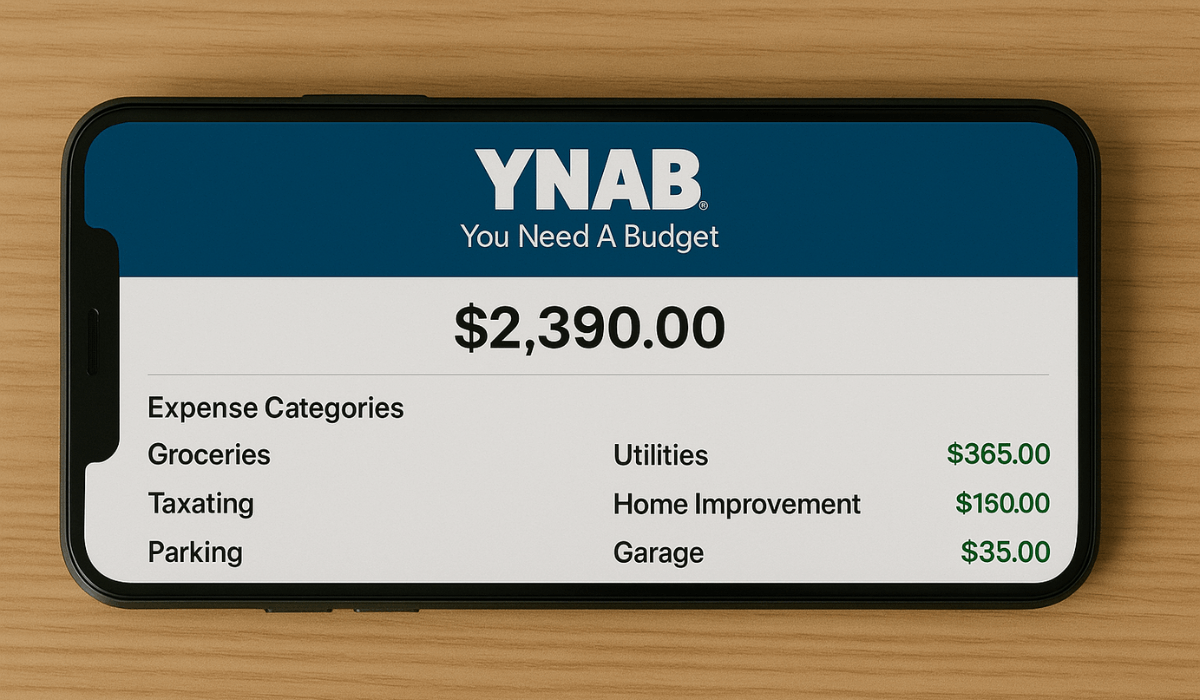

YNAB (You Need A Budget)

YNAB is designed to help students stick to a strict budget by assigning every dollar a specific purpose.

It focuses on zero-based budgeting to help students live within their means.

Features:

- Zero-based budgeting system

- Tracks spending and helps set financial goals

- Provides detailed reports and insights

Best For:

- Strict budgeting

- Financial goal-setting

- Expense tracking

PocketGuard

PocketGuard helps students visualize their disposable income by linking to their bank accounts and automatically categorizing expenses.

Features:

- Tracks income and spending

- Identifies areas for saving

- Provides a simple overview of finances

Best For:

- Simple, no-frills budgeting

- Quick financial check-ins

- Identifying saving opportunities

Albert

Albert is a financial assistant app that provides budgeting tools, automatic savings, and personalized financial insights for students looking to save money easily.

Features:

- Automatic savings suggestions

- Personalized financial insights

- Tracks spending and offers budgeting tips

Best For:

- Automatic savings

- Personalized financial advice

- Budgeting and tracking spending

Expensify

Expensify is ideal for students who need to track receipts for work or school-related expenses. It allows users to scan receipts and generate reports.

Features:

- Receipt scanning and tracking

- Expense categorization

- Report generation

Best For:

- Expense reporting

- Receipt management

- Tracking school/work-related expenses

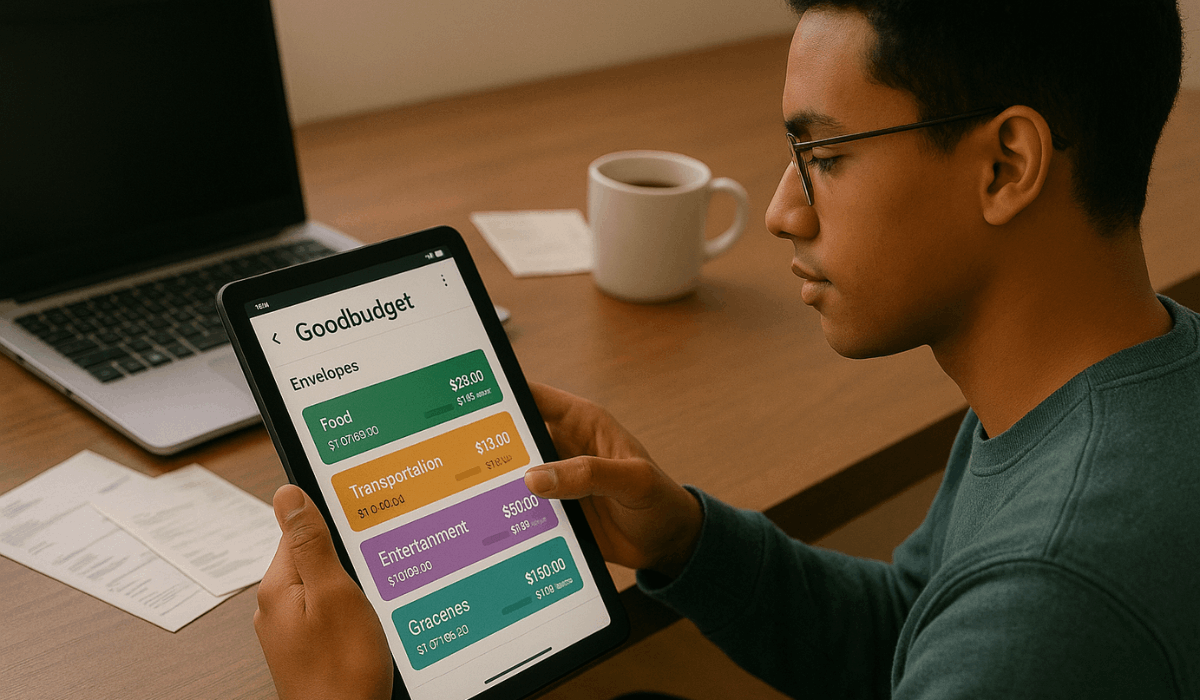

GoodBudget

GoodBudget utilizes the envelope budgeting system to help students manage their finances by categorizing expenses.

Features:

- Virtual envelope budgeting

- Tracks cash flow and expenses

- Syncs across multiple devices

Best For:

- Envelope budgeting

- Cash flow management

- Multi-device syncing

How to Choose the Right Platform for You

Choosing the right finance app depends on your goals and needs. Identifying key features will help you find the best app for managing your finances.

Here are key considerations to guide your choice:

- Assess Your Financial Needs: Determine if you require budgeting, expense tracking, or more advanced features, such as credit monitoring or savings tools.

- Consider Ease of Use: Select an app that is easy to navigate and aligns with your financial style.

- Check for Bank Integration: Ensure the app is linked to your bank for real-time transaction tracking.

- Evaluate Security Features: Look for apps that offer robust security, including encryption and two-factor authentication.

- Look for Customization: Find an app that lets you personalize categories, goals, and alerts.

- Read Reviews and Ratings: Check user feedback to understand the app’s performance and reliability.

Tips for Maximizing App Use

To get the most out of your finance app, it’s essential to use its features effectively.

Here are some tips to help you make the most of your app and stay on top of your finances:

- Set Clear Financial Goals: Use the app to define specific financial goals, such as saving for a trip or paying off debt.

- Regularly Track Your Spending: Consistently monitor your expenses to stay within budget and identify areas for improvement.

- Review Reports and Insights: Utilize financial reports and insights to gain a deeper understanding of your spending habits and adjust your budget accordingly.

- Set Up Alerts: Set up spending or savings alerts to keep you informed and on track.

- Take Advantage of Automation: Use features like automatic savings or bill reminders to stay organized and save time.

- Update Your Budget Regularly: Adjust your budget as needed based on changes in income, expenses, or financial goals.

Integrating Finance Apps with Other Life Tools

Integrating finance apps with other life tools can help you manage both your money and time more efficiently.

This approach provides a more straightforward overview of your finances, allowing you to balance other daily tasks. Here’s how to integrate finance apps with various tools:

- Calendar Apps: Sync with Google or Apple Calendar to track financial dates, such as bill payments or savings goals.

- Productivity Apps: Link with apps like Todoist or Trello to set reminders for budgeting or reviewing expenses.

- Goal-Setting Apps: Integrate with apps like Habitica to track financial and personal goals in one place.

- Fitness and Health Apps: Sync with health apps to track fitness-related expenses or progress toward health goals.

- Time Management Apps: Utilize apps like RescueTime to track the time spent on financial tasks, thereby boosting efficiency.

The Bottomline

Managing your finances as a student is crucial for building good habits and ensuring long-term financial stability.

By choosing the right apps for managing student finances efficiently, you can stay on top of your spending, savings, and goals.

Start today by downloading one of the apps mentioned and taking control of your financial future!